Global Digital KYC And ID Verification Suite

Fraud Prevention, AML and Global KYC Solutions

Fully Certified Regtech Solutions

5 - 10 sec

12000+

150+

2500+

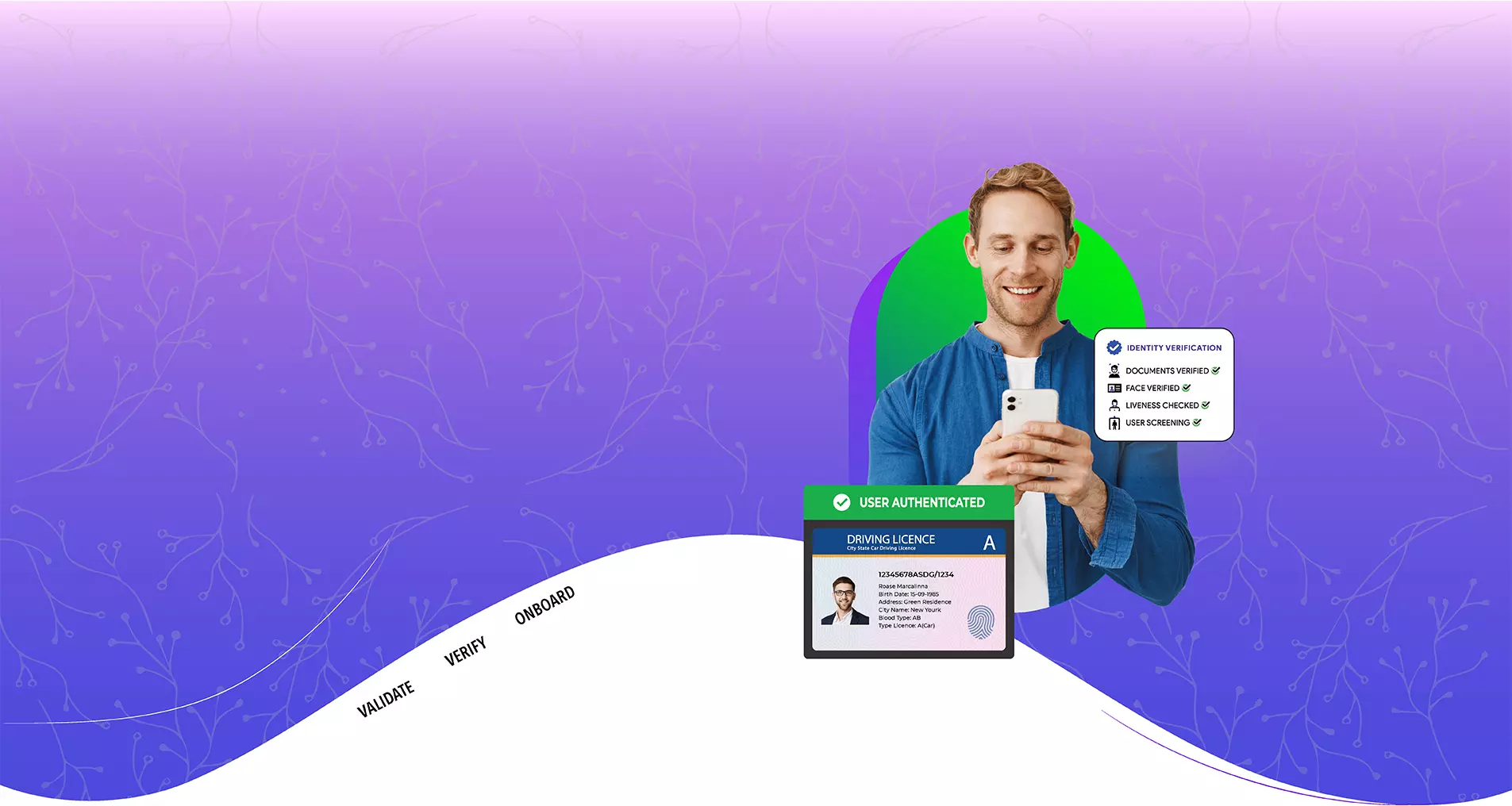

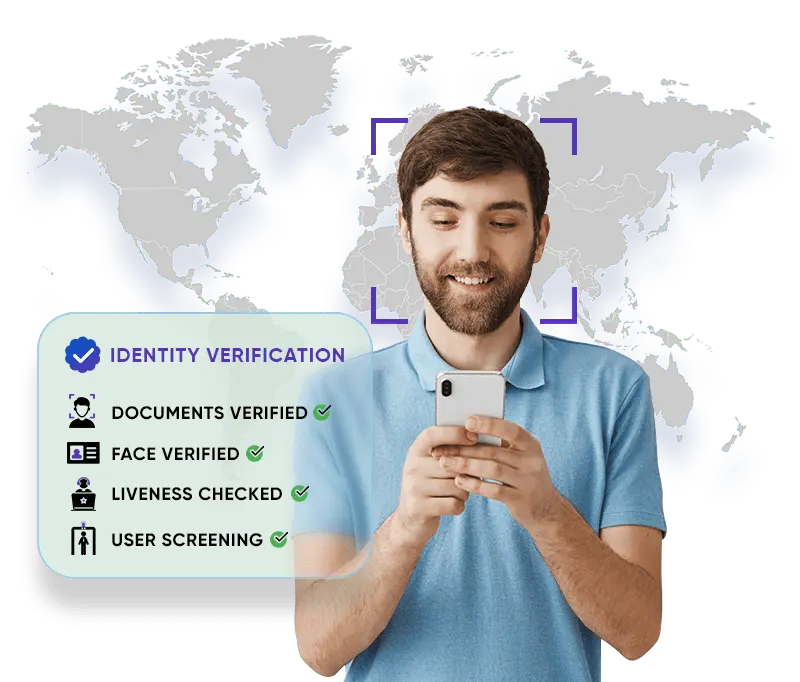

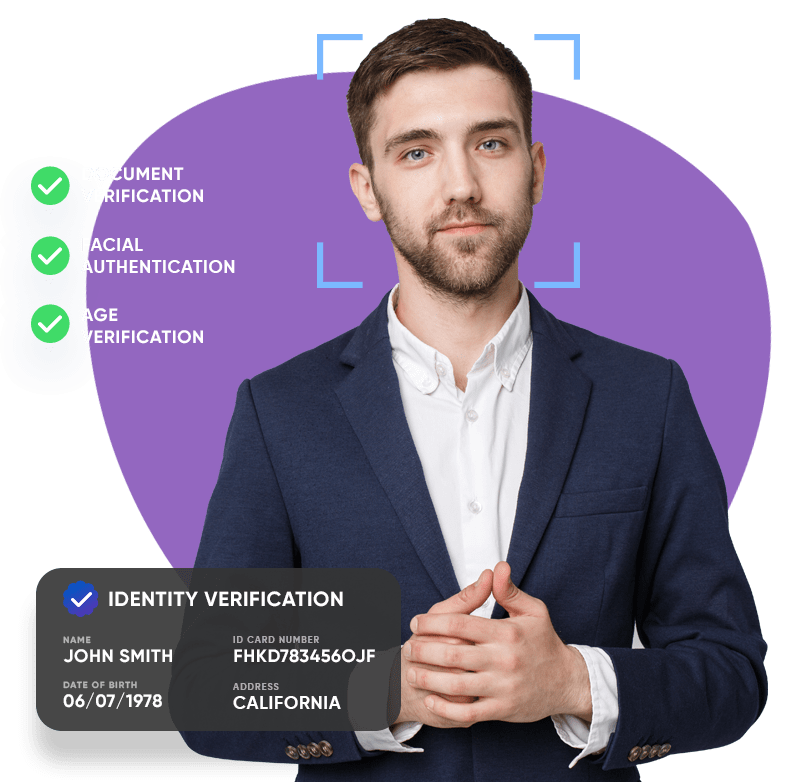

Know Your Customer in 10 Seconds

Validate and Confirm Your Identity Through National ID, Driving License and Passport

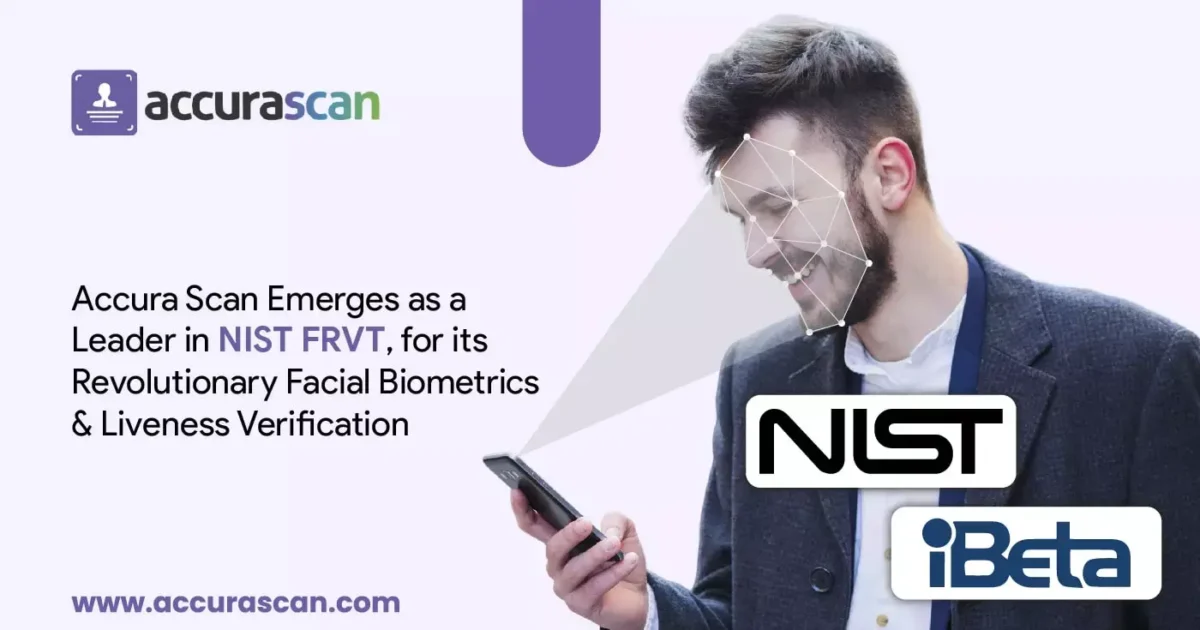

User Validation and Authentication Through Facial Biometrics and Liveness Check

An Intelligent Combination of AI and OCR To Maintain the Highest Standards of Accuracy

Verify, Validate and Onboard Customers Seamlessly within Seconds

AML

Screening

AML Transaction Monitoring & Sanctions Screening Made Fast and Easy

Real-Time Recognition of Peps/Terrorists and Blacklisted Organizations

In-Depth Compliance Checks Based on FATF, OFAC, Interpol, UN, And HMT Standards

Robust Databases of High-Risk Individuals, Watchlists, Sanctions and Adverse Media

Lists include Specially Designated National (SDN), Gramm-Leach-Bliley Act (GLBA), Driver's Privacy Protection Act (DPPA). Others include Asia/Pacific Group on Money Laundering (APG), Financial Action Task Force on Money Laundering in South America (GAFISUD), The Middle East and North Africa Financial Action Task Force (MENAFATF).

Facial Biometric

Authentication

Biometric Signup, Login and Transaction Approval

Ensure The User Is Present & LIVE On CAMERA While Completing the KYC Journey

Face Detection and Instant Liveness Check to Prevent Identity Fraud

Our Testimonials

Your Trusted Identity Verification Partner

Trust Accura Scan for Reliable and Accurate Identity Verification Solutions. With Our Cutting-Edge Technology and Exceptional Customer Service, We Are Committed to Delivering Seamless User Experiences and Ensuring the Security of Your Business

Tushar Singhal

- Solution Consultant & Development Manager

We have used Accura Scan for one of the use case where we need to implement OCR solution, and it worked very well for us. I appreciated the support we received from technical and sales team of Accura Scan. We wish them all the best for their future endeavours.

Vivek Agrawal

- Sr. Vice President & Head Enterprise Business

We partner with Accura Scan for the Digital Identity and KYC solution. The solution is feature rich and we have implemented Accura Scan for quite a number of Banks and Fintechs. The flexibility of the solution along with the ability to host it on-premises or on cloud makes Accura Scan a partner of choice for us. Kudos to the team and especially to YP for leading it from the front. Look forward to the continued support and many more successes in the years to come.

Deepak Arora

- VP – Product Management

It has been a pleasure partnering & interacting with team Accura Scan. Their suite of Digital KYC, Identity Verification & Customer Onboarding Solutions hold a lot of potential for & find extensive application in Telecom, Mobile Payments & Digital Banking.

Himanshu Tewari

- Head - Business Process Improvement

At Gulf Bank, striving towards improving the customer journey is a top priority, as to ensure that customers receive the best and most advanced services. Amongst the various digital transformation initiatives that were launched to customers embarking on their onboarding journey, was working closely with Accura Scan, since 2021. Accura Scan’s advanced digital solutions helped offer an innovative user verification experience, that aided in creating a seamless and frictionless onboarding experience. We look forward to further exploring the vast and advanced services that Accura Scan provides to further enhance our digital services.