Digital KYC And Identity Verification Solution for Oman

Digital KYC And Identity Verification Solution for Oman

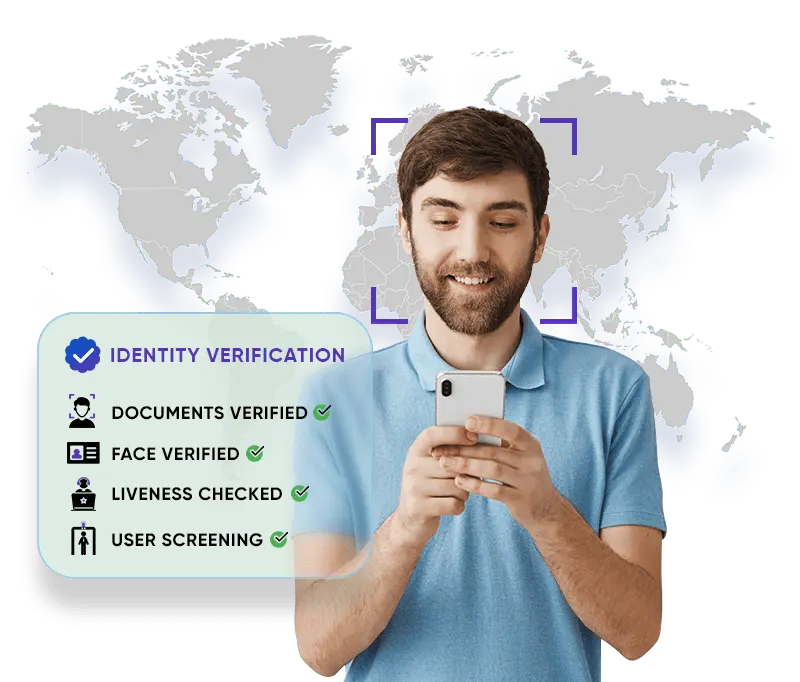

Know Your Customer in 10 Seconds

In the dynamic landscape of Oman, where businesses are constantly seeking streamlined processes, Know Your Customer (KYC) verification plays a pivotal role. Accura Scan, an innovative KYC solution, revolutionizes the customer onboarding experience in the Sultanate. Harnessing state-of-the-art AI technology, Accura Scan enables lightning-fast identity verification in just 10 seconds, ensuring a seamless and efficient onboarding process for businesses across various industries. By expediting KYC procedures, Accura Scan empowers Omani enterprises to save valuable time and resources, accelerating growth and enhancing operational efficiency.

Accura Scan offers Oman a formidable tool in the fight against fraud and identity-related risks. The platform's real-time document scanning and facial recognition capabilities ensure the authenticity of customer information, bolstering trust and security for businesses and customers alike.

The impact of Accura Scan extends beyond swift verifications; it paves the way for enhanced customer experience and loyalty in Oman. By simplifying the onboarding process to just 10 seconds, businesses can offer a user-friendly and hassle-free experience to customers, leaving a lasting positive impression. Moreover, Accura Scan prioritizes data protection and compliance, adhering to global data privacy standards like GDPR, ensuring that sensitive customer data remains secure and confidential. With the unmatched advantages of Accura Scan, businesses in Oman can embrace growth opportunities, build robust customer relationships, and stay at the forefront of digital innovation.

Facial Biometric Authentication For Oman

AML

Screening for Oman